Resources

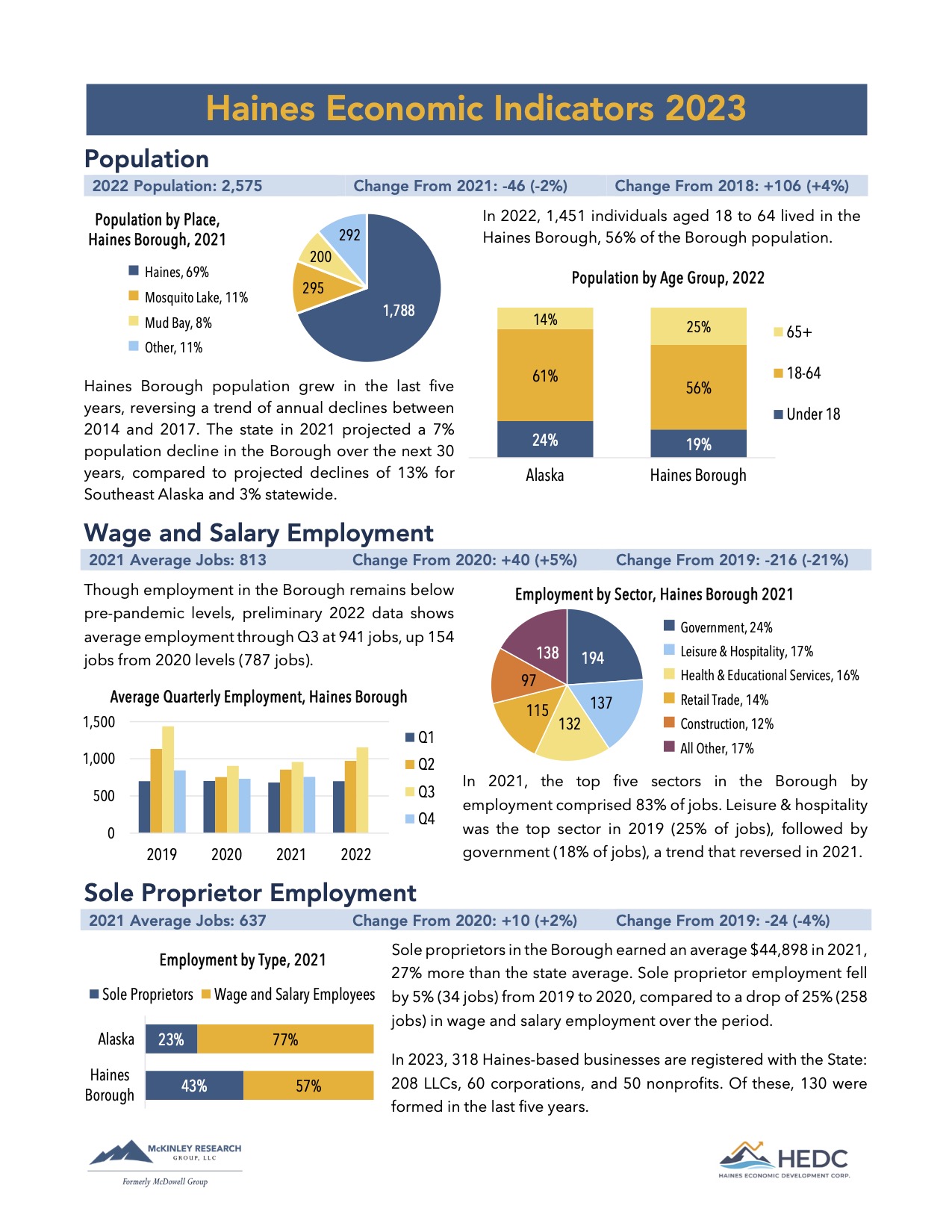

Economic Reports

A large part of what we do here at HEDC is researching and reporting on Haines’ economy and finding solutions to continually enhance the well-being of our community. These reports offer insight into our local economy, development goals, and strategies.

Latest News Archive

Board of Directors Meeting 5/2 at 5:00pm

2024 Visitors Guide

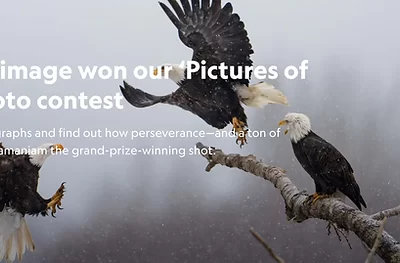

Local bald eagles pictured in National Geographic’s Photo of the Year

Where did our 2005 graduates end up?

Local Frequency program launches in Haines

HEDC Open House

Haines and the outdoor recreation economy

Haines Housing Survey

ARPA Nonprofit Recovery Fund

ByHaines – Shop Local and Save

Pivot Program Opens

Sally Andersen hired as Executive Director

Make Haines Home

The Community Prospectus Website was built with the goal to promote Haines as a great place for location-neutral workers to live, and a great place to take advantage of Haines’ Opportunity Zone designation and invest in brick and mortar businesses.

Small Business Center

The Chilkat Valley is home to a very entrepreneurial community. Thinking of starting a business in Haines? Check out the following resources available to you:

Ideas and business plans: The most important part of starting a business is a business plan.

Spruce Root: Business Basics (online):

An entirely self-paced course that will teach you the essentials of running a thriving business. During the 3-hour course, you will learn how to create a simplified business plan, budget for start-up expenses, calculate financial projections, and gain an understanding of marketing, customer discovery, and business licenses and taxes. To complete the course, users must have access to a personal computer with internet access and be able to use Google documents and sheets. Users in need of a computer are encouraged to stop by the HEDC office on Tuesdays and Thursdays 1-5 pm.

259 Main Street, Gateway Building, 3rd floor #26

The cost of the workshop is $25. Anyone who sees this fee as a barrier to participation should email grow@spruceroot.org to request a waiver before filling out an application.